Accelerate your NETWORTH , Here’s HOW?

Here is a post on How to accelerate your Net Worth & achieve Financial Independence. Increase in net worth will accelerate your journey towards Financial Independence

Net-worth gives a clear measure of your wealth. In accounting terminology, “net worth is really everything you own of significance (your assets) minus what you owe in debts (your liabilities)”. Assets include cash and investments, your home and other real estate, cars or anything else of value you own.

Now when it is clear what is net worth, I am sure you would want it to keep growing at a healthy rate. A healthy growth rate in net worth will give you a confidence in your life with respect to your finances.

Here are some of the methods I am listing down which can accelerate growth in your net worth. All these steps are simple and you can implement them in your financial plan to stay on top of your finances and off course net worth.

- Work towards paying all debts.

Kill the debt with highest interest first. Usually the personal loan which we take for some holidays or some family function carry the highest interest rate. Same is with the credit card debt. Make sure that you get rid of personal loan and credit card debt. Then focus on getting rid of consumer loan which you took for buying that 85 inch cool TV, auto loan for your cool SUV. The EMI on these loans might look small but if you do that math you end up paying a lot in interest on them. Remember the price you pay for any item bought on these loans are the cost of principal plus the cost of interest. Once you are done with all high interest loans, target home loan. Yes, though you get benefit on home loan but a loan is a loan. The feeling of having freedom with no loan is something out of the world. - Increase your contribution towards the Employee provident fund.

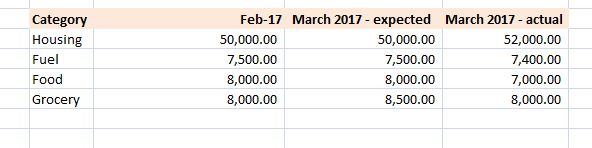

If you do not have PF – Provident fund account with your company, open a PPF account with any public sector bank and max-out the limit of yearly deposit in the first month of every financial year. These account ensures that over a long run, you accumulate enough corpus which can help you plan your retirement years they way you want. - Make a budget.

This article details on how to make a basic working budget. Once budget is made, trim your unwanted expenses. Remember you will not be able to trim your unwanted expenses unless you make a budget. Be on top of your expenses and cut down all unnecessary expenses. - Do not let your extra cash sitting idle in low interest savings account.

If you have huge amount sitting idle in savings account, it is losing its value. Currently savings account give only 2%-3% interest. And the inflation is 6%-7% which means your money is losing its value. Immediately put your money to work harder through mutual funds, sweep in deposits, fixed deposits, stock market based on your risk appetite. The returns in these investment streams are higher than the regular savings account and money in them ensures that you are beating inflation and not losing value of your money. - Start building a mutual fund portfolio.

This is from long term perspective and invest into this through systematic investment plans across a diversified range of mutual funds consisting of diversified equity funds, balanced funds, large caps, mid caps. This does not need expertise, it only requires basic knowledge which is available freely on the internet. - Reinvest all the income generated from your investments.

Do not blow away the gains from your investments. If you keep re-investing, it will help in increasing your investment corpus considerable and that too quickly. Also this exercise of yours coupled with the brilliance of compound interesting will accelerate your net worth growth. - Invest a fixed amount regularly, every month.

Pay yourself first – this should be the mantra. Automate your investments. Suppose you receive your salary in the first week of the month, keep your systematic investment plan SIPs automated for the first week of every month. This will ensure that you keep investing every month without a break. Remember – the one who invests regularly and over a long duration reaps the benefits. - Invest all the windfalls you get. Do not splurge.

Gifts and inheritance money can be very helpful in accelerating your net worth. Remember more money you put in investment, more your investment corpus would be and more money it will generate. - Do not go crazy about new vehicles every few years.

Remember that vehicles are merely an instruments for going from point A to point B. Also remember there is a huge cost associated with the new vehicles in terms of insurance, maintenance, running cost etc. And it is a fact that a vehicle loses about 20%-25% of its value the moment it comes out of the showroom and it is a depreciating asset. - Do not accumulate loans to purchase stuff.

Every new loan you take is a liability and is a hindrance in your plan to financial independence. Every new EMI / monthly payment added to your monthly income will surely decelerate the net worth growth.

If you follow the above listed steps diligently and track your progress, I am sure you will see a positive movement in your net worth. You need to improve, evolve your approach constantly in order to see your net worth moving northward. Each one of us has different lifestyle, different expenses but what is discussed in this article are basic building blocks to improve your net worth.

Improvement in net worth will result in creating wealth and early financial independence. Don’t you want the same?

Recent Comments