A simple budget can save you from 5 big troubles

A simple budget can save you from 5 big troubles

Most of us are scared of the word “Budget”. We think that the word is too technical for our comfort and should be best avoided. Also, most of us don’t like to budget or keep track of our spending. We are least concerned about the reason for this behavior as we think that the life goes on without budgeting also.

In spite of living in a Hi-Tech era, we avoid using technology to track and plan our finances.

If we start creating a simple budget and start tracking our expenses, we can cure 5 of our life’s major financial troubles. I am sure these financial woes are common to most of us reading this stuff.

Trouble #1

You have absolutely no idea about your money.

- Only thing you know that salary credit in the beginning of the month.

- You are clueless where your money has evaporated halfway down every month.

- You rely on credit cards for month end expenses – not by choice but more because of compulsion.

How making and sticking to a budget can change this?

When you start creating a budget and record expenses

- You know exactly how much money goes where

- You can cut down on certain unwanted expenses so that your money lasts till month end

- You are not clueless about your money- you have a proper track of income and expenses

Trouble #2

You are not saving any money

- You do not have any emergency fund

- You have trouble with money when it comes to fulfil your needs and goals quite often – e.g. you wish to upgrade your kitchen, but you don’t have savings to do so or you want to go for a holiday abroad, but you can not do so as you don’t have sufficient funds.

How making and sticking to a budget can change this?

- When you start budgeting, you start saving and investing money

- A systematic goal based savings and investments can ensure that you have money for your future needs and goals

- You become more systematic with your money when you start budgeting

- You can plan annual vacations well and as a family you can have a good time

Trouble #3

Your mindless spending habits

- You don’t realize but your entertainment expenses are very high

- You are spending way more than you should on eating out

- Your clothing expenses are all time high

- You are paying over the roof for your internet and phone bills

How making and sticking to a budget can change this?

- You will come to know about your money leaks when you make budget.

- You can free up loads of money vanishing through money leaks

- You can cut down all unnecessary and expensive money spending when you start writing expenses

Trouble #4

You struggle to get what you want

- You are unable to save for your retirement

- You want to buy a house but you are unable to arrange for the downpayment

- You are unable to save and accumulate money for your kids education

- You badly want to travel abroad for holidays but you can not afford to do so

How making and sticking to a budget can change this?

- When you budget, you have track of expenses and leftover money

- Leftover money can be invested wisely

- With goal based investing, you can ensure you have enough money / savings to fulfil your dreams

Trouble #5

Cash Flow problem is common with you

- You do not have a cash buffer

- You are unable to go even for a casual meal at a good restaurant over the weekend if some guests drop in

- You do not have enough money for emergency repair of your vehicle

How making and sticking to a budget can change this?

- With budgeting, you can save cash and have an emergency fund which can tackle emergency situation for you

- Again writing expenses can plug money leaks and free up money which can be utilized towards emergency fund

- Freeing up money leaks can also help you in building cash buffer which is useful for events like casual dinner out etc.

So, take charge of your money. Do not count budgeting and writing expenses as burden. If you start budgeting and writing expenses, you can avoid many common issues and problems related to money which you are facing in your day to day life.

Remember – Budgeting and tracking your spending is the first step towards financial independence and this has been emphasized by every financial planner.

Resource:

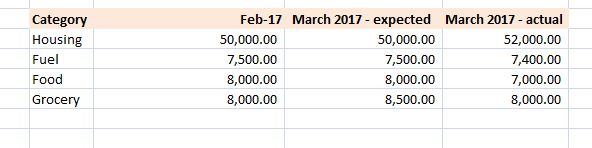

Here is how to make a simple budget?

Happy investing !!!

Recent Comments